| 일 | 월 | 화 | 수 | 목 | 금 | 토 |

|---|---|---|---|---|---|---|

| 1 | ||||||

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | 15 |

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | 28 |

- linear regression

- 한서지리지

- 선형회귀분석

- t test

- ANOVA

- 고구려

- categorical variable

- post hoc test

- 창평

- 단군

- 기자조선

- 패수

- 독사방여기요

- 후한서

- 풍백

- 우분투

- 신라

- 통계

- 히스토그램

- 기자

- R

- 태그를 입력해 주세요.

- 한서

- Histogram

- spss

- 유주

- repeated measures ANOVA

- 낙랑군

- 지리지

- 통계학

- Today

- Total

獨斷論

Home prices are rising 본문

Lance Lambert

Wed, July 21, 2021, 4:00 AM

In the early weeks of the COVID-19 recession it looked like the housing market was headed for a slump—or worse a crash. After all, how could the market stay afloat amid Great Depression-era level joblessness and state-issued shutdowns that kept agents from doing in-person showings?

What transpired next shocked the industry: Instead of sinking, housing went on a historic run. Pandemic-spurred low interest rates coupled with remote workers ready to sneak further out of the city in search of other abodes helped to set off a frenzy. It was only intensified by the fact we're amid the five-year period when the largest portion of millennials, born in 1989 to 1993, are hitting their 30s—the all-important first-time home buying years. That swell of buyers has cut the number of U.S. homes for sale in half. With fewer homes on the market, bidding wars ensued.

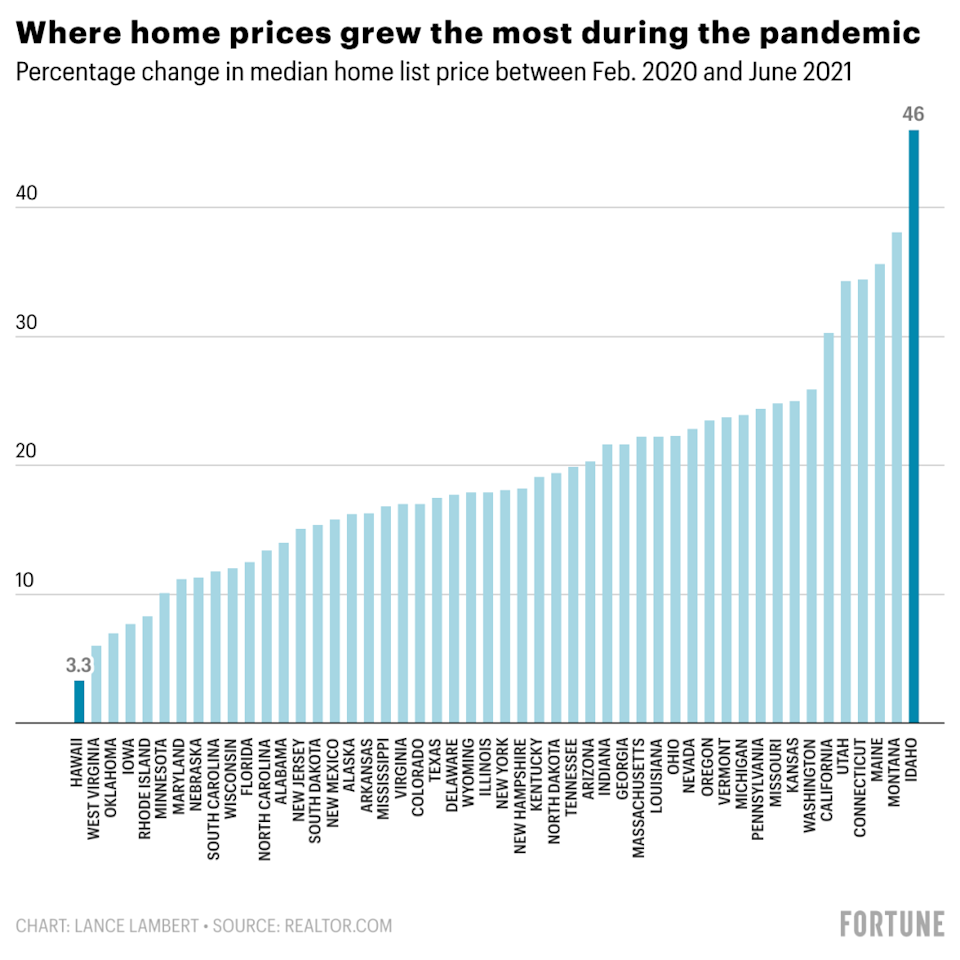

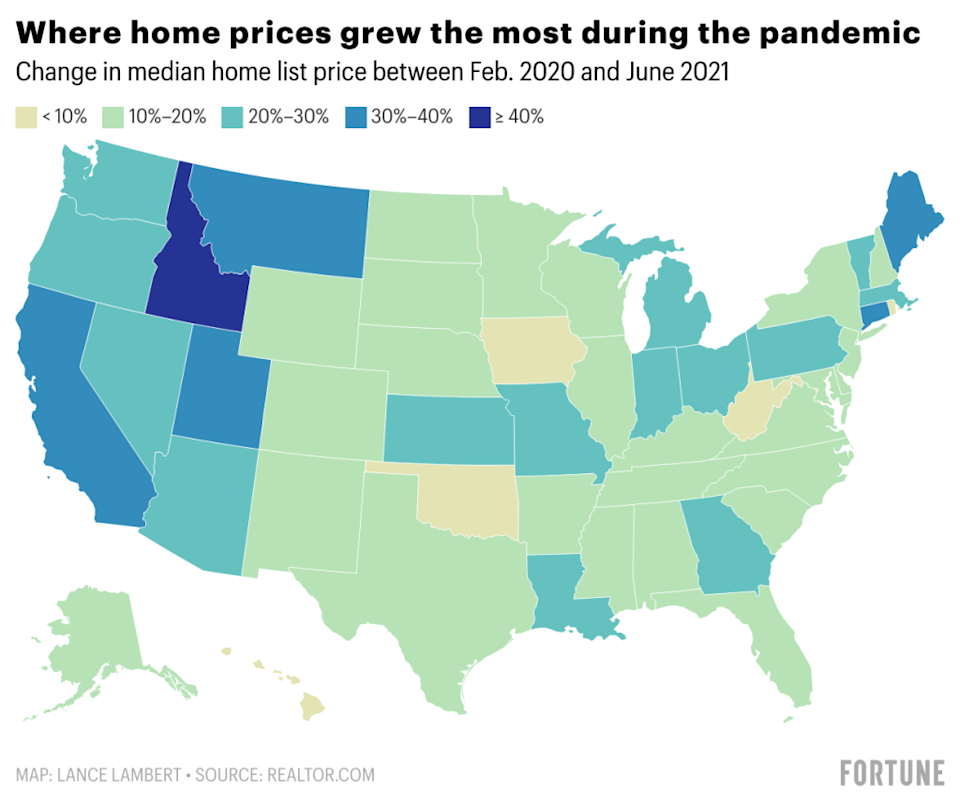

Home prices are growing faster this spring and summer than any period on record—including the period leading up to the 2008 bubble. Indeed, this spring the Case-Shiller National Home Price Index hits the highest growth level on record. It's still moving up: As of June, median list prices were up 13% over the past 12 months. In total, median home list prices are up a staggering 24% since the onset of the pandemic, climbing from $310,000 in Feb. 2020 to $385,000 in June 2021. But when Fortune looked at the regional data we found the picture varies dramatically by state: The uptick in Idaho (46%), which saw the largest increase in prices during the pandemic, is 15 times larger than the increase in Hawaii (3%).

After Idaho, the rest of the top 10 states that saw the largest price increases were Montana (38%), Maine (36%), Connecticut (34%), Utah (34%), California (30%), Washington (26%), Kansas (25%), Missouri (25%), and Pennsylvania (24%).

Some of the hot spots include Big Sky, Montana and Portland, Maine, which got flooded with hungry second home buyers, when deep pocketed Americans fled big cities for spacious vacation homes. But why does California rank so high? After all, when the pandemic struck techies decamped from expensive markets like San Jose and San Francisco. While those areas did cool, outlining areas throughout the Golden State boomed. Communities that are over an hour away from major job centers in the state got locked into competitive bidding wars as workers realized their old five day in-person workweek is dead.

The ability to work from anywhere is also why so many Californians are taking off for Boise, Idaho. Since the onset of the crisis, median home list price in Boise is up a staggering 42% to $536,600, according to realtor.com data. Boise, which has a strong tech scene of its own, is the epicenter of Idaho's boom.

But where is the housing market headed next? Already, there are signs of cooling as would-be homebuyers get fatigued by soaring prices and losing out in bidding wars. Since bottoming out in April, inventory levels—aka supply—on realtor.com are up 12%. But that doesn't mean prices will fall. CoreLogic forecasts 3% price growth in the next 12 months. Why? Inventory is still very tight—down 42% since the onset of the crisis. Not to mention the demographic wave of millennial first-time home buyers continues to hit the market. It's getting a bit more buyer friendly, but this is still a seller's market.

The ten smallest upticks are in Hawaii (3.3%), West Virginia (6%), Oklahoma (7%), Iowa (8%), Rhode Island (8%), Minnesota (10), Maryland (11%), Nebraska (11%), South Carolina (12%), and Wisconsin (12%) rounding out the bottom ten. No industry has been hurt more by the COVID-19 pandemic than tourism. That may explain Hawaii's relatively low home appreciation during the pandemic. But even the bottom 10 markets saw large upticks, which speaks to the surprising strength of housing during this crisis.

This story was originally featured on Fortune.com

Home prices are rising faster than any time on record

See how your state is doing.

fortune.com